Rule of 40 For Saas & Tips To Calculate it

-

- What Is The Rule Of 40?

- Measuring Growth Rate And Profitability

- The Rule Of 40 Formula

- How To Calculate The Rule Of 40 (Example)

- How Many SaaS Companies Exceed The Rule Of 40?

- Why Use The Rule of 40?

- Here Are 4 Crucial Benefits of Rule of 40

- When To Use The Rule Of 40: Should You Measure The Rule Of 40 As A Startup?

- What Is A Good SaaS Growth Rate?

- Balancing Competing Goals

In the fast-paced SaaS industry, where growth and profitability are the twin pillars of success, the Rule of 40 emerges as a guide for software companies navigating the intricate landscape.

As a strategic metric, the Rule of 40 encapsulates the delicate equilibrium between expansion and fiscal prudence, offering a comprehensive gauge of a SaaS company's revenue growth rate.

This article explores the essence of the Rule of 40—its definition, the partnership between growth rate and profitability, and the pragmatic formula behind it.

What Is The Rule Of 40?

In the dynamic world of Software as a Service (SaaS), the Rule of 40 emerges as a pivotal metric, encapsulating the essence of sustainable growth. Coined by astute investors, this Rule offers a comprehensive perspective by blending two critical elements: a company's growth rate and profitability margin. Simply put, the rule implies that a SaaS company's profit margin plus growth rate should equal at least 40%.

This metric recognizes the complexities most SAAS companies face between scaling a customer base and ensuring financial viability. While rapid growth is a common pursuit for many mature SAAS businesses, the Rule of 40 advocates for a balanced strategy, emphasizing that a healthy SaaS company should exhibit a harmonious combination of expansion and fiscal responsibility.

Measuring Growth Rate And Profitability

To understand the Rule of 40, it's crucial to grasp how growth rate and profitability are measured in the context of marketing and other sales strategies of SaaS companies.

Growth Rate

The growth rate of subscription revenue serves as a litmus test for a company's ability to expand its customer base and increase recurring revenue over a specified period, with revenue growth input often measured through Monthly or Annual Recurring Revenue (MRR/ARR).

Profitability

Conversely, Net profit margin is the profitability metric considered in the Rule of 40. To compute the percentage of net income, divide net profit by total revenue, then multiply the quotient by 100. This indicator shows how effectively a business turns income into profit.

The Rule Of 40 Formula

At the heart of the Rule of 40 lies a simple yet powerful formula that serves as a compass for evaluating the holistic health of a SaaS enterprise. The Rule dictates that the combined percentage of a company's profit margin and growth rate must equal or exceed 40%.

The Rule of 40 formula is straightforward: Growth Rate + Profit Margin = Rule of 40 Percentage.

Mathematically, if a company has a 20% annual revenue growth rate, its profit margin should be at least 20% to meet the Rule of 40 (20% revenue growth rate + 20% profit margin = 40%).

How To Calculate The Rule Of 40 (Example)

To demonstrate the methodical computation of this crucial static, let us examine the financial records of a hypothetical SaaS enterprise for a specified timeframe.

-

Growth Rate: The growth rate is computed as follows if a SaaS company's MRR increases from 1 million to 1.5 million in a year:

Growth Rate=(Ending MRR−Starting MRR)Starting MRR×100Growth Rate=Starting MRR(Ending MRR−Starting MRR)×100

(1.5−1)1×100=50%1(1.5−1)×100=50% is the growth rate in this instance.

-

Profit Margin: Determining the profit margin from a 300,000 net profit and 1.5 million in total revenue during the same period is as follows:

Profit Margin=Net ProfitTotal Revenue×100Profit Margin=Total RevenueNet Profit×100

The profit margin in this scenario is 300,0001,500,000×100=20%1,500,000300,000×100=20%.

-

Rule of 40: Combining the profit margin and growth rate:

Rule of 40= Profit Margin+Growth Rate

Substituting the values from our example, the Rule of 40 is 50%+20%=70%50%+20%=70%.

In this example, the hypothetical SaaS company surpasses the Rule of 40 benchmark with a cumulative score of 70%, signaling a robust balance between profitability and growth.

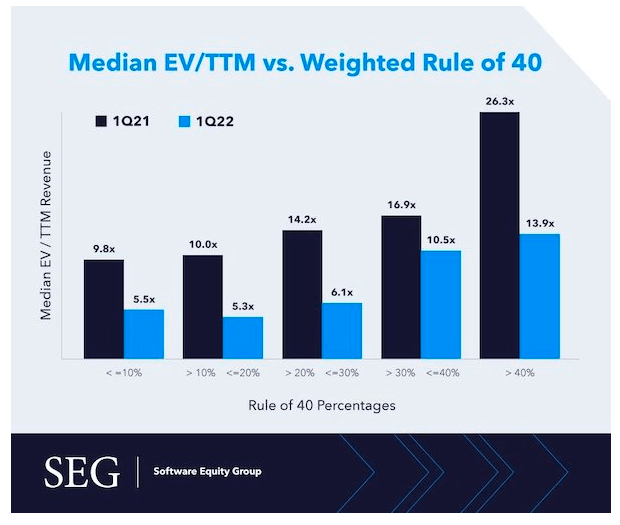

How Many SaaS Companies Exceed The Rule Of 40?

The adherence to the Rule of 40 varies across SaaS companies. At the same time, many strive to meet or surpass this benchmark, but not all succeed. The competitiveness and unique dynamics of each SaaS business model contribute to this diversity.

The Software Equity Group observed a direct link between valuation and the 40% rule of thumb. Companies like Zoom, Twilio, and Datadog, exceeding this benchmark, witnessed substantial valuation growth. The accompanying graph depicts the potential impact on SaaS valuations by consistently surpassing the 40% Rule of 40.

The prevalence of adherence to the Rule of 40 is influenced by a multitude of factors, including industry dynamics, a company's operating performance and size, and a company's total revenue growth, rate, and stage.

1. Industry Variances: In certain industries, SaaS businesses may find achieving a profitability margin Rule of 40 percentage above the industry benchmark more challenging. Factors such as longer sales cycles, long-term growth, or higher initial investment requirements from existing customers can impact a company's ability to balance growth and its profitability margin.

2. Company Size and Maturity: Larger, more established SaaS companies often have the resources and market presence to meet or surpass the Rule of 40. Startups, on the other hand, may prioritize rapid growth over customer retention and market share capture, initially sacrificing profitability.

3. Investor Expectations: Investor expectations also play a role in shaping adherence to the Rule of 40. Some investors may prioritize rapid growth, while others seek a balanced approach that includes sustained profitability and sales efficiency.

4. Benchmark for Success: The SaaS Rule of 40 is not a one-size-fits-all benchmark. While exceeding 40% is generally considered a positive sign for a healthy SaaS business, some companies in the SaaS industry may still thrive with a lower combined percentage, depending on their unique circumstances and strategic goals.

Why Use The Rule of 40?

Several compelling reasons drive the adoption of this metric as a key performance indicator:

1. Holistic Performance Evaluation: The Rule of 40 provides a comprehensive assessment balancing profitability, considering both growth and profitability. This holistic perspective ensures that companies do not prioritize one aspect at the expense of the other, fostering a balanced approach to sustainable success.

2. Investor Confidence: Investors keen on identifying companies with long-term potential turn to the Rule of 40. A SaaS company exceeding the 40% threshold instills confidence, signaling a healthy equilibrium between aggressive growth and sound financial management.

3. Strategic Decision-Making: Executives leverage the Rule of 40 as a strategic tool for decision-making. It offers insights into the effectiveness of current business strategies, guiding adjustments in pricing models, operational efficiency, and overall business cycle trajectories.

4. Market Competitiveness: In a crowded SaaS landscape, staying competitive is paramount. Companies consistently meeting or exceeding the Rule of 40 demonstrate an ability to navigate the complexities of growth and profitability, enhancing their appeal to both customers and investors.

Here Are 4 Crucial Benefits of Rule of 40

Embracing the Rule of 40 as a guiding metric in the SaaS realm brings forth a myriad of tangible advantages that extend beyond the numerical evaluation of growth and profitability of the same company's targeted market alone. Let's explore four crucial benefits that underscore its significance in shaping the trajectory of SaaS companies:

1. Comprehensive Performance Insight: The Rule of 40 provides a nuanced understanding of a SaaS company's performance by harmonizing growth profit margins and profitability. This holistic view enables stakeholders to assess not just the scale of expansion but also the efficiency with which recurring revenue is transformed into sustainable profits.

2. Investor Attraction and Confidence: Investors seek assurances beyond mere revenue figures. The Rule of 40, by emphasizing a balanced approach, serves as a guide for potential investors, instilling confidence in a company's ability to navigate market challenges and deliver long-term, sustained value creation.

3. Informed Strategic Decision-Making: SaaS executives benefit from the Rule of 40 as a strategic compass. It guides decision-makers in optimizing their business strategies, be it adjusting pricing models, refining marketing approaches, or enhancing operational efficiency, fostering a culture of data-driven decision-making.

4. Competitive Resilience: The Rule of 40 is a badge of resilience in a fiercely competitive market. Companies consistently meeting or surpassing the Rule of 40 SaaS-% benchmarks showcase an ability to not only grow but do so sustainably, positioning themselves as formidable players capable of weathering industry fluctuations.

When To Use The Rule Of 40: Should You Measure The Rule Of 40 As A Startup?

While the Rule of 40 is a valuable metric for established SaaS companies, startups may need to approach it with caution. Early-stage companies often prioritize rapid growth over profitability and gross margins as they aim to capture market share and establish their presence.

However, startups should not entirely disregard the Rule of 40. Instead, they can use it as a reference point while understanding that exceeding the 40% threshold might not be immediately achievable.

For startups, a trajectory toward profitability falling the Rule of 40 can serve as a long-term goal, with a gradual shift in free cash flow toward profitability as the business matures.

What Is A Good SaaS Growth Rate?

Assessing the revenue growth rate of a proficient SaaS enterprise relies on diverse elements such as industry, target market, and developmental stage. Typically, a robust revenue growth rate for a SaaS company ranges from 20% to 50%. This range allows for substantial expansion while maintaining a level of cash flow stability.

However, the ideal growth rate can vary, as early-stage startups might prioritize faster growth to gain traction. At the same time, more mature companies may focus on sustaining consistent, albeit slightly lower, growth rates while improving profitability margins.

Balancing Competing Goals

Striking the balance between profitability and growth requires a strategic approach that considers market dynamics, customer acquisition costs, and the competitive landscape.

1. Customer Acquisition Costs (CAC): Assessing the Rule of 40 should go hand-in-hand with evaluating customer acquisition costs. A high growth rate of monthly recurring revenue may be unsustainable if the cost of marketing and sales tactics for acquiring customers is equal to the recurring revenue growth rate and customer acquisition cost is high.

2. Churn Rate: High growth can be offset by a high churn rate if customers are not retained over the long term. SaaS companies must prioritize customer satisfaction, retention, and customer acquisition costs to ensure sustained growth.

3. Investment in Innovation: While profitability is vital to maximize growth, SaaS companies should also allocate resources for innovation. Research and development expenditures guarantee the creation of new features, expert services, and goods, preserving market competitiveness and emphasizing expansion.

4. Market Conditions: External factors, such as economic conditions and industry trends, can also impact a company's ability to achieve both growth and profitability.

Frequently Asked Questions

How is the growth rate calculated in the Rule of 40?

The growth rate is calculated by measuring the Monthly or Annual Recurring Revenue (MRR/ARR) growth over a specific period, expressed as a percentage.

Why is the Rule of 40 relevant for investors?

Investors use the Rule of 40 as a quick and reliable metric to gauge a SaaS company's potential for long-term success. It provides insights into a company's ability to balance growth aspirations with financial sustainability.

Can startups benefit from the Rule of 40?

While startups may not immediately target the Rule of 40, it can serve as a long-term goal. Early-stage startups often prioritize rapid growth, gradually incorporating profitability considerations as they mature.

How does the Rule of 40 contribute to strategic decision-making?

The Rule of 40 contributes to strategic decision-making by offering insights into the effectiveness of current business strategies. Executives can use it to inform adjustments in pricing models, marketing strategies, and overall business trajectories.

.png)